“The challenge of your career” – our takeaways from the BPF Annual Conference 2022

We had a fantastic morning at the BPF Annual Conference on 15 June 2022. It was the first since the coronavirus pandemic and there was only one topic on the agenda – the path to achieving Net Zero.

The conference included keynote speakers from industry, government, and policy as well as shining a light on the perspective of the next generation of leaders in property via the involvement of BPF Futures.

As the property industry finds itself centre stage in the challenge of a generation, Chris Stark from the UK Climate Change Committee (UKCCC) noted the difficulties of the real estate sector for climate change. He proposed, however, that the difficult bit is actually the most exciting part of the journey.

Here’s our key takeaways from the day.

We've been here before – and it's damaging your real estate portfolio

Global temperatures have been at their current level before, millions of years ago. At that time the sea level was 20 metres higher than it is now. This really highlights the danger that we face if we fail to take action now. The heatwave experienced by the UK in 2018 was used as an example of impact on UK real estate. It resulted in subsidence claims costing £64 million. This is an issue for us, right now, and the UK hazards caused by climate change are only forecast to increase as the global temperature increases (sorry).

Sustainability is in your financial interest

It’s not all doom and gloom. With the cost of gas skyrocketing at the moment, it is cheaper to use renewable electricity than fossil fuels. There are also economic benefits to retrofitting buildings; sustainable assets generally have a higher rental value at a price premium. The Bank of England and Lloyds Bank both commented that there are a lot of investors wanting to inject cash into green real estate, leading to more discounted lending as the green lending market grows. Whilst it is estimated that £50-60bn capital investment per year is needed to meet the 2050 Net Zero target, it is expected that with returns from savings on expensive fossil fuels the overall cost will be close to zero. The UK has some of the "leakiest" buildings in Europe so there is also big saving potential from insulating.

Sustainability is important for talent retention

Perhaps one of the biggest takeaways from the day was the expectation that younger generations have for their employers in terms of progressing towards Net Zero by 2050. BPF Futures members consider sustainability issues a critical factor when considering workplace options. They have clear expectations of the property industry to end greenwashing and produce tangible strategies towards achieving Net Zero. Putting in place innovative ESG strategies (social as well as environmental) is key. If a company cannot innovate to solve this problem, junior colleagues feel that they cannot add value in an organisation that is simply doing things the way they have always done them.

Greenwashing is holding us back

Chris Stark (UKCCC) advised the industry to minimise the use of offsets, as it is more important to focus on reducing actual emissions even if that means you won’t quite hit Net Zero. What matters more, is pushing along the national strategy towards reaching that goal. It is his view that de-carbonising buildings is the big story for the next 20 years, and the challenge of our careers.

Sarah Breeden from the Bank of England also highlighted the risks to the economy associated with greenwashing. She said that there is a wall of capital wanting to invest in green, however, with no clear pathway to Net Zero, investors are finding it hard to identify genuine opportunities.

Doing something now is more important than being perfect

This was another of the key messages from the day. One of the greatest challenges for sustainability at the moment is the difficulties in measuring our progress; however time is running out to have a meaningful impact. Sarah Breeden (Bank of England) said that, when making disclosures on sustainability, it is better to be roughly right “now” than precisely right when it is too late. Catherine Sherwin of BlackRock phrased this as trying to make better choices, even if they cannot be measured in their entirety.

We need to get better at sharing data and ideas

This is not a new challenge for the property industry, but with an estimated 90% of investment in sustainability needing to come from the private sector, the quicker we can learn the better. One of the key challenges in funding de-carbonisation is obtaining tenant data relating to carbon. In the absence of legislation mandating the sharing of data as can be found in countries like France, we need “radical collaboration” (to borrow COP’s slogan).

At the conference the BPF launched its Net Zero pledge for members, which aims to enable businesses of all sizes to engage with this issue practically and strategically. The overarching theme was one of collaboration: we need to work together to tackle this global problem.

Whilst the UK is on track to reach Net Zero by 2050, not all of the rest of the world is. In fact, global emissions are still rising. The UK needs to set an example of working together.

We need to prioritise areas of greater impact

Large scale renewable generation is well on its way and so we need to focus on being ready to switch to electricity as a priority, rather than installing a couple of solar panels on houses which will not make a fundamental difference in the long term. To be ready to switch over from gas heating in 2030, action needs to be taken now: training installers, testing hydrogen (and coming up with another solution if that doesn’t work!), preparing the grid and installing district heating networks.

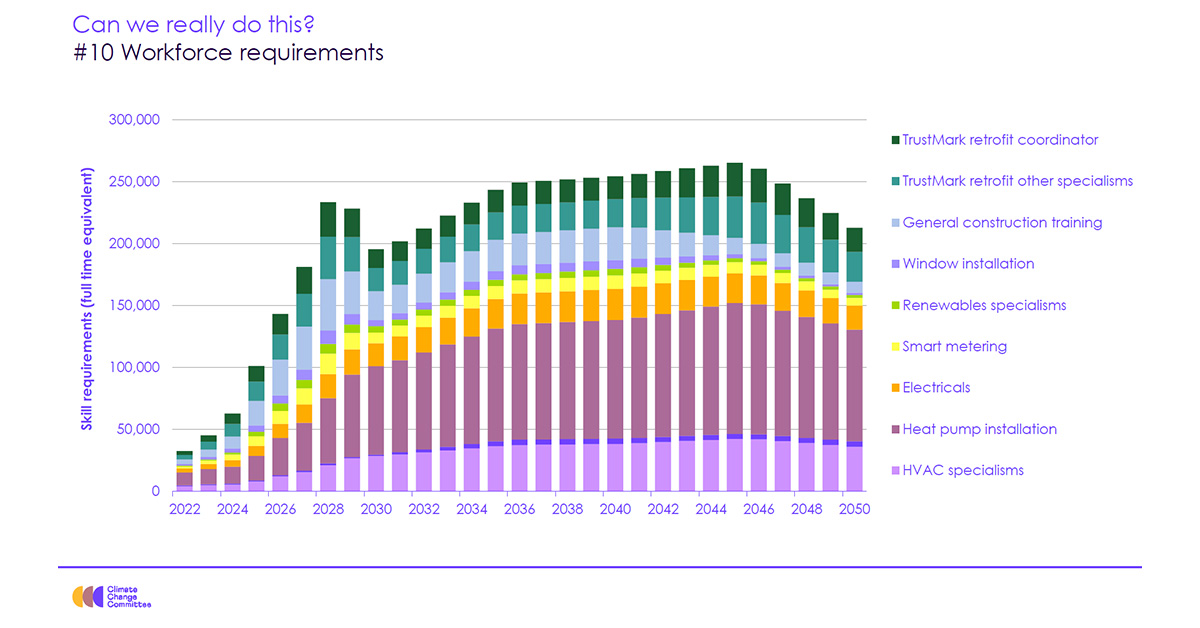

Yael Selfin of KPMG flagged that whilst only a mild recession next year is anticipated, there is a concern that there will be a drop in investment (including in skills training) in 2023 which could hamper our ability to prepare for switching to renewables. The following graph shows the number of jobs needed in this area to help us reach this important goal.

Image source: UKCCC

The private sector has a heavy role to play

As aforementioned, the vast majority of investment in sustainability will need to come from the private sector. The regulators are aware of their role in this challenge, with the FCA reportedly putting out proposals in July to engage with the need for regulation to help investors differentiate between real green investment and greenwashing. In politics, whilst there is a cross party consensus that sustainability is an issue, there remains a debate over the change of pace.

Retrofitting is crucial to reduce embodied carbon and upgrade the UK's existing building stock. There is a view that the incentives for demolition (such as works on new builds being zero-rated for VAT) need to be removed and for the planning system to be overhauled to enable developers to focus on retrofitting, but in the meantime, there have been calls for the industry to consider what it can do on an asset by asset basis. The idea of cross investment was also floated - using profits from switching to renewable energy to assist with the cost of retrofitting. To reach the target set for de-carbonisation we need to repurpose 3% of building stock every year for 25 years; we are currently only managing 1%.

Laura Haworth is a Senior Associate in the Commercial Real Estate team with a keen interest in ESG matters and renewable energy. Lauren Melachrino is an Associate in the Commercial Real Estate team and a BPF Futures member.

Forsters are a member of the BPF and currently sit on the BPF’s Planning, Build to Rent and VAT committees.