Ploughing through taxes: what do the IHT changes really mean for farmers?

The latest Government budget, as has been well publicised, has caused outcry amongst the farming community with somewhere between 20,000 – 40,000 braving snow to make their voice heard. But what do the inheritance tax (IHT) changes really mean for farmers?

Agricultural and Business Property Reliefs

Most of the discussion has centred around the Agricultural Property and Business Property Reliefs being capped at £1m, with IHT payable at 20% thereafter. The Government say that only 500 estates or so will be affected each year. Is this true? Let’s look at some recent government figures.

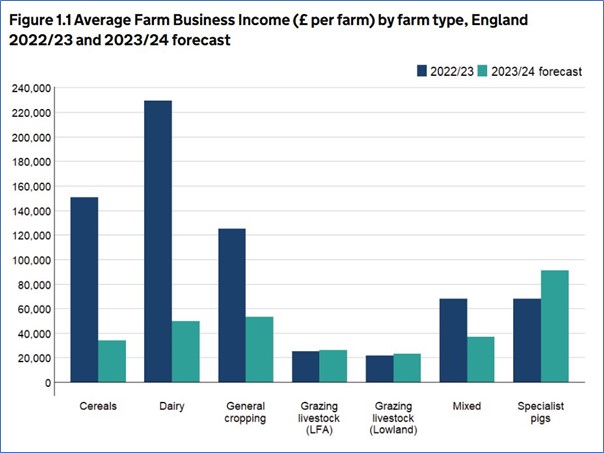

The below graph is from the Government’s “Farm Business Income in England, 2023/24 forecast“. Farm Business Income (“FBI”) is the total output generated by the farm business minus total farm costs. There is some discussion as to what an “average farm” is but the Government suggests that the English average is about 210 acres. It is not immediately obvious how they defined “farm”. For example, is this the area owned by one entity or is it the area farmed by one business? To highlight a different view of “average”, Tom Heathcote, former head of agri-consultancy at Knight Frank and founder of Heathcote Farm Consultancy, said that “an average UK farm to include around 800 acres (600 arable, 150 grass, 50 woodland), one house, two cottages, and a mixture of modern and traditional buildings” (Farmers Weekly).

Calculating your potential IHT bill

If we proceed assuming that the “government average” is correct combined with the average price of arable land (£11,000 per acre or so currently), you reach a pure land value (excluding buildings, machinery or any farm houses) of £2,310,000 for an “average” arable farm. Assuming there is a farm house, agricultural buildings, expensive machinery (bearing in mind second hand combine harvesters that are one or two years old can cost £300,000 or more) some woodland and possibly farmworker cottages, this could value of the overall business could easily reach £3,000,000 (if not more).

The impact on farms

If we however assume a relatively conservative value of £3,000,000, this means that an “average” arable farm based on government numbers could be looking at an IHT bill now of up to £400,000 (assuming they are paying 20% on the value above £1,000,000). If we assume that it is owned by a married couple, it includes their main home, they make full use of their gifts to each other and some land up to the £1,000,000 cap is transferred to the next generation on the death of the first, this could reduce the bill to nothing (with the £1,000,000 APR allowance having been used twice and the full £1,000,000 nil-rate band having been used). That, however, relies on multiple moving parts, the above assumptions and planning structures that are not appropriate or even possible for many farms.

An average general cropping farm (according to the Government forecasts) such as this would have made £53,000 in 2023/2024, a cereals farm even less at £34,000. This will also be subject to income and other taxes. Bearing in mind subsidies are disappearing, how volatile farming can be and just how expensive machinery is, how is the “average” farm going to find the money to pay their IHT bills?

While larger estates, particularly those in trust where the tax bill will be 3% every 10 years on the value above £1,000,000, may be able to absorb the cost, it is still going to have a large impact on farming. I have already been involved in discussions where trust owned estates are planning to move away from agricultural land holdings because they no longer make sense against higher-yielding assets in order to meet their tax liabilities. This will ultimately mean farmland will be sold and it will lead to reduced investment into our agricultural sector. Neither of these are necessarily good for food security or the tenant farming sector.

Succession planning

The figures will be much more nuanced than this article suggests, but this will clearly impact many farms. Farm owners will need to ensure that they have considered their succession planning in detail, and not just from a financial perspective. For example, the farm will likely need to provide for the person gifting in their retirement, so gift with reservation of benefit rules need to be carefully considered. It is also a big decision to give away part of your business during your lifetime when you still rely on it and potentially farm on it.

It is more important than it has been for decades to take advice on farm succession planning.